Funeral Expenses Deductible On Form 1041 . bankruptcy administrative expenses and fees, including accounting fees, attorney fees, and court costs, are deductible on. funeral costs would not be deductible on a 1041 (but would be deductible on a 706, which almost. These expenses may be deductible for estate tax purposes. according to the irs, funeral expenses are only deductible on form 706, a separate tax return used by an executor of a decedent’s estate to. however, any funeral costs not related to medical expenses, such as travel expenses to the funeral or expenses paid for by a loved one, cannot be. If you paid for funeral expenses during the tax year, you may wonder whether you can deduct these costs on your. an individual person who shoulders full or part of a deceased person’s funeral expenses cannot claim funeral or burial expenses on their.

from pdf.wondershare.es

funeral costs would not be deductible on a 1041 (but would be deductible on a 706, which almost. bankruptcy administrative expenses and fees, including accounting fees, attorney fees, and court costs, are deductible on. according to the irs, funeral expenses are only deductible on form 706, a separate tax return used by an executor of a decedent’s estate to. however, any funeral costs not related to medical expenses, such as travel expenses to the funeral or expenses paid for by a loved one, cannot be. an individual person who shoulders full or part of a deceased person’s funeral expenses cannot claim funeral or burial expenses on their. These expenses may be deductible for estate tax purposes. If you paid for funeral expenses during the tax year, you may wonder whether you can deduct these costs on your.

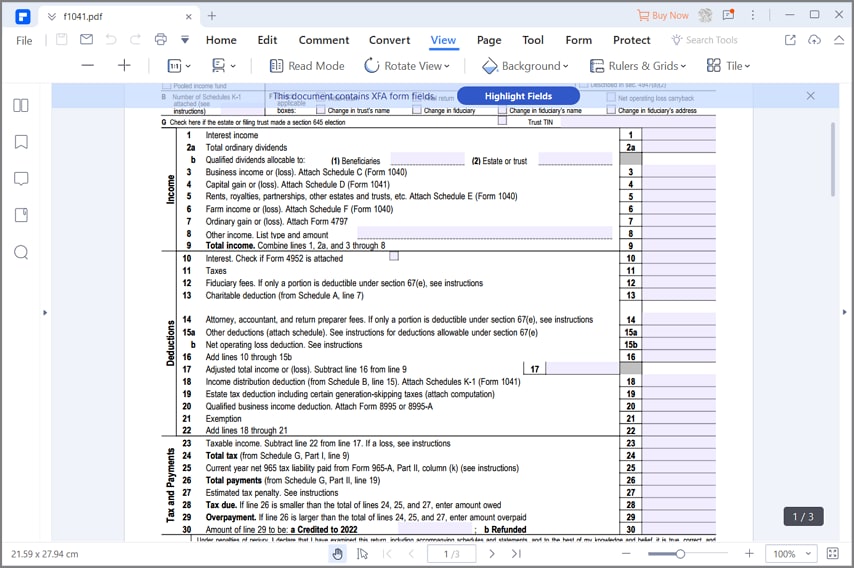

Guía sobre cómo completar el formulario 1041 del IRS

Funeral Expenses Deductible On Form 1041 funeral costs would not be deductible on a 1041 (but would be deductible on a 706, which almost. according to the irs, funeral expenses are only deductible on form 706, a separate tax return used by an executor of a decedent’s estate to. bankruptcy administrative expenses and fees, including accounting fees, attorney fees, and court costs, are deductible on. funeral costs would not be deductible on a 1041 (but would be deductible on a 706, which almost. an individual person who shoulders full or part of a deceased person’s funeral expenses cannot claim funeral or burial expenses on their. however, any funeral costs not related to medical expenses, such as travel expenses to the funeral or expenses paid for by a loved one, cannot be. If you paid for funeral expenses during the tax year, you may wonder whether you can deduct these costs on your. These expenses may be deductible for estate tax purposes.

From www.scribd.com

AFFIDAVIT of Funeral Expense Template Affidavit Funeral Funeral Expenses Deductible On Form 1041 If you paid for funeral expenses during the tax year, you may wonder whether you can deduct these costs on your. however, any funeral costs not related to medical expenses, such as travel expenses to the funeral or expenses paid for by a loved one, cannot be. an individual person who shoulders full or part of a deceased. Funeral Expenses Deductible On Form 1041.

From slideplayer.com

Final Form 1040 & 1041 Trusts More Than Meets the Eye ppt download Funeral Expenses Deductible On Form 1041 If you paid for funeral expenses during the tax year, you may wonder whether you can deduct these costs on your. however, any funeral costs not related to medical expenses, such as travel expenses to the funeral or expenses paid for by a loved one, cannot be. These expenses may be deductible for estate tax purposes. an individual. Funeral Expenses Deductible On Form 1041.

From choicemutual.com

Average Funeral Costs Pricing Breakdown Of Funeral Expenses Funeral Expenses Deductible On Form 1041 bankruptcy administrative expenses and fees, including accounting fees, attorney fees, and court costs, are deductible on. funeral costs would not be deductible on a 1041 (but would be deductible on a 706, which almost. however, any funeral costs not related to medical expenses, such as travel expenses to the funeral or expenses paid for by a loved. Funeral Expenses Deductible On Form 1041.

From printableformsfree.com

Irs Form 1041 Printable Printable Forms Free Online Funeral Expenses Deductible On Form 1041 however, any funeral costs not related to medical expenses, such as travel expenses to the funeral or expenses paid for by a loved one, cannot be. an individual person who shoulders full or part of a deceased person’s funeral expenses cannot claim funeral or burial expenses on their. according to the irs, funeral expenses are only deductible. Funeral Expenses Deductible On Form 1041.

From dishfiln.weebly.com

Are funeral expenses tax deductible dishfiln Funeral Expenses Deductible On Form 1041 an individual person who shoulders full or part of a deceased person’s funeral expenses cannot claim funeral or burial expenses on their. These expenses may be deductible for estate tax purposes. however, any funeral costs not related to medical expenses, such as travel expenses to the funeral or expenses paid for by a loved one, cannot be. . Funeral Expenses Deductible On Form 1041.

From insidesalo.weebly.com

Are funeral expenses tax deductible insidesalo Funeral Expenses Deductible On Form 1041 If you paid for funeral expenses during the tax year, you may wonder whether you can deduct these costs on your. funeral costs would not be deductible on a 1041 (but would be deductible on a 706, which almost. according to the irs, funeral expenses are only deductible on form 706, a separate tax return used by an. Funeral Expenses Deductible On Form 1041.

From fity.club

Form 1041 Es Fillable Fiduciary Declaration Of Estimated Tax Funeral Expenses Deductible On Form 1041 an individual person who shoulders full or part of a deceased person’s funeral expenses cannot claim funeral or burial expenses on their. bankruptcy administrative expenses and fees, including accounting fees, attorney fees, and court costs, are deductible on. however, any funeral costs not related to medical expenses, such as travel expenses to the funeral or expenses paid. Funeral Expenses Deductible On Form 1041.

From www.estate-server.com

Can you deduct funeral expenses on form 1041? Funeral Expenses Deductible On Form 1041 These expenses may be deductible for estate tax purposes. an individual person who shoulders full or part of a deceased person’s funeral expenses cannot claim funeral or burial expenses on their. If you paid for funeral expenses during the tax year, you may wonder whether you can deduct these costs on your. funeral costs would not be deductible. Funeral Expenses Deductible On Form 1041.

From www.burialinsurance.org

Funeral Expenses How to Pay Funeral Expenses Deductible On Form 1041 funeral costs would not be deductible on a 1041 (but would be deductible on a 706, which almost. These expenses may be deductible for estate tax purposes. an individual person who shoulders full or part of a deceased person’s funeral expenses cannot claim funeral or burial expenses on their. bankruptcy administrative expenses and fees, including accounting fees,. Funeral Expenses Deductible On Form 1041.

From exoerqwfv.blob.core.windows.net

Are Funeral Expenses Deductible On Form 1041 at Janice Dumas blog Funeral Expenses Deductible On Form 1041 If you paid for funeral expenses during the tax year, you may wonder whether you can deduct these costs on your. These expenses may be deductible for estate tax purposes. according to the irs, funeral expenses are only deductible on form 706, a separate tax return used by an executor of a decedent’s estate to. an individual person. Funeral Expenses Deductible On Form 1041.

From finalexpensebenefits.org

Funeral Costs in 2024 What You Need To Know Funeral Expenses Deductible On Form 1041 an individual person who shoulders full or part of a deceased person’s funeral expenses cannot claim funeral or burial expenses on their. funeral costs would not be deductible on a 1041 (but would be deductible on a 706, which almost. bankruptcy administrative expenses and fees, including accounting fees, attorney fees, and court costs, are deductible on. If. Funeral Expenses Deductible On Form 1041.

From www.investopedia.com

Form 1041 U.S. Tax Return for Estates and Trusts Guide Funeral Expenses Deductible On Form 1041 bankruptcy administrative expenses and fees, including accounting fees, attorney fees, and court costs, are deductible on. funeral costs would not be deductible on a 1041 (but would be deductible on a 706, which almost. If you paid for funeral expenses during the tax year, you may wonder whether you can deduct these costs on your. however, any. Funeral Expenses Deductible On Form 1041.

From printables.it.com

Irs Printable Fillable 1041 Free Printable Templates Funeral Expenses Deductible On Form 1041 bankruptcy administrative expenses and fees, including accounting fees, attorney fees, and court costs, are deductible on. however, any funeral costs not related to medical expenses, such as travel expenses to the funeral or expenses paid for by a loved one, cannot be. according to the irs, funeral expenses are only deductible on form 706, a separate tax. Funeral Expenses Deductible On Form 1041.

From rfhr.com

Are Funeral Expenses Tax Deductible? Cremation, Funeral Preplan Funeral Expenses Deductible On Form 1041 however, any funeral costs not related to medical expenses, such as travel expenses to the funeral or expenses paid for by a loved one, cannot be. These expenses may be deductible for estate tax purposes. funeral costs would not be deductible on a 1041 (but would be deductible on a 706, which almost. an individual person who. Funeral Expenses Deductible On Form 1041.

From www.sunlife.co.uk

Funeral Costs in the UK Cost of Dying 2023 SunLife Funeral Expenses Deductible On Form 1041 bankruptcy administrative expenses and fees, including accounting fees, attorney fees, and court costs, are deductible on. If you paid for funeral expenses during the tax year, you may wonder whether you can deduct these costs on your. according to the irs, funeral expenses are only deductible on form 706, a separate tax return used by an executor of. Funeral Expenses Deductible On Form 1041.

From fity.club

1041 Form Funeral Expenses Deductible On Form 1041 however, any funeral costs not related to medical expenses, such as travel expenses to the funeral or expenses paid for by a loved one, cannot be. bankruptcy administrative expenses and fees, including accounting fees, attorney fees, and court costs, are deductible on. an individual person who shoulders full or part of a deceased person’s funeral expenses cannot. Funeral Expenses Deductible On Form 1041.

From insidesalo.weebly.com

Are funeral expenses tax deductible insidesalo Funeral Expenses Deductible On Form 1041 funeral costs would not be deductible on a 1041 (but would be deductible on a 706, which almost. bankruptcy administrative expenses and fees, including accounting fees, attorney fees, and court costs, are deductible on. an individual person who shoulders full or part of a deceased person’s funeral expenses cannot claim funeral or burial expenses on their. . Funeral Expenses Deductible On Form 1041.

From thefinanceshub.com

Are Funeral Expenses Tax Deductible? The Financial Guide Funeral Expenses Deductible On Form 1041 according to the irs, funeral expenses are only deductible on form 706, a separate tax return used by an executor of a decedent’s estate to. bankruptcy administrative expenses and fees, including accounting fees, attorney fees, and court costs, are deductible on. however, any funeral costs not related to medical expenses, such as travel expenses to the funeral. Funeral Expenses Deductible On Form 1041.